Your credit score improvement journey starts with knowledge. Whether you’re applying for a home loan, seeking a new credit card, or hoping to lower your interest payments, this three-digit number, your CIBIL score is the key. It determines your access to the best financial opportunities in India.

This comprehensive guide breaks down credit score improvement using proven strategies and expert insights. We’ll show you exactly how your credit score is calculated, how to identify and fix errors, and the clear steps needed to achieve that coveted 750+ credit score. Ready to transform your financial standing? Here’s everything you need to know.

What is Credit Score and Why It’s Your Financial Report Card

Before pursuing tangible credit score improvement, you must understand the fundamentals.

Your credit score is your financial reputation distilled into a single number. It’s a numerical summary of how trustworthy you are with money. Lenders use this score to decide whether to approve your loan application, what interest rate to offer, and how much risk you represent. In essence, it’s the meter they use to measure your creditworthiness.

What is a credit score? Your credit score is compiled by major bureaus, including CIBIL (Credit Information Bureau India Limited), CRIF High Mark, and Experian. These agencies analyze your complete credit history and calculate a score reflecting how responsibly you’ve handled borrowed money.

Why Your Credit Score Matters

A strong, good credit score in India unlocks financial opportunities:

- Lower interest rates on loans and credit cards

- Higher credit limits and better approval odds

- Better terms on home loans and personal loans

- Faster loan approvals and fewer eligibility questions

A poor score does the opposite; it locks you out of better financial products and costs you thousands in higher interest over time.

Recommended Read: What Makes Up Your Credit Score? Key Factors Explained by FixMyScore

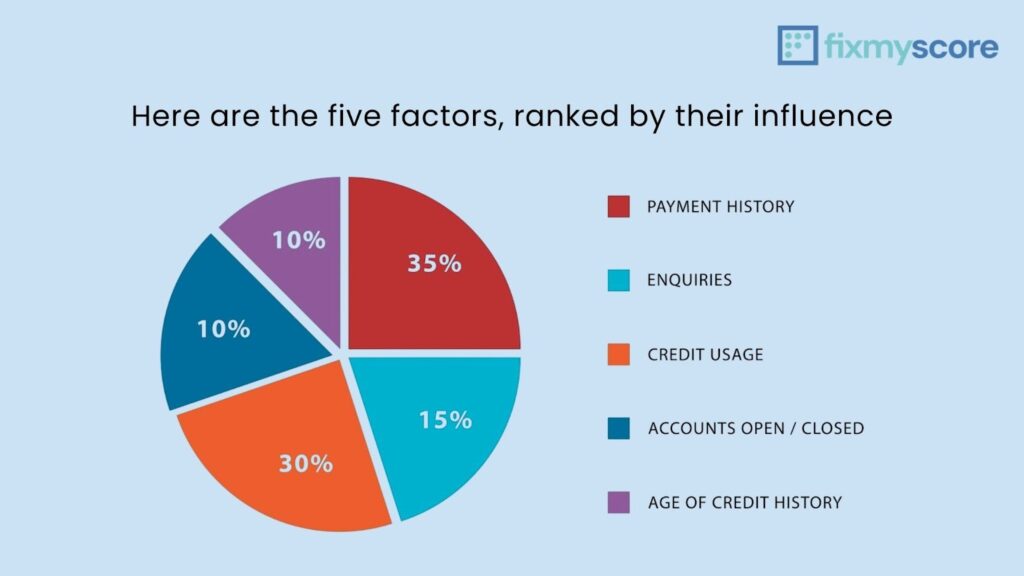

The 5 Key Factors That Determine Your Credit Score

Understanding how your credit score is calculated is the foundation of genuine, lasting credit score improvement. Your score rests on five key pillars. Master each one, and you control your financial future.

1. Payment History (Approx 35% Weight) — The Most Critical Factor

Payment history is the heavyweight champion of credit scoring factors. It shows lenders whether you pay your bills on time, every time. A single late payment, especially if it is 60 or 90 days overdue, can significantly damage your score and take years to recover from.

Why it matters: Lenders see payment history as proof of reliability. One missed payment signals risk; multiple missed payments signal danger.

How to improve your credit score:

- Set up automatic payments for at least the minimum amount due

- Use calendar reminders for all payment due dates

- If you’ve already missed a payment, make it current immediately

- Focus on making on-time payments going forward, this is your fastest path to recovery.

Need help? If you’ve missed a payment, credit score recovery is possible. Discover 8 proven hacks to Fix Late Credit Card Payments.

2. Credit Utilization Ratio (Approx 30% Weight) — Your Spending Signal

Your credit utilization rate is the percentage of available credit you’re actively using. Lenders prefer to see low utilization because it signals that you are not dependent on credit and can manage your balances effectively.

Example: If you have a credit card with a Rs 1,00,000 limit and owe Rs 30,000, your utilization is 30%.

The Golden Rule for credit utilization: Keep it below 30%. Aim for 10% or lower for optimal results.

Why it matters: High utilization signals financial stress to lenders. It suggests you’re dependent on credit and struggling to manage balances. Low utilization shows you’re financially stable and in control.

How to reduce credit utilization fast:

- Pay down your balance before your statement closing date (not just the due date)

- Request credit limit increases from issuers

- Spread balances across multiple cards if needed

- Consider paying more than once per month to lower what gets reported

Pro tip: Pay down balances strategically. A payment made before your statement closes will show a lower balance to credit bureaus, immediately improving your utilization score.

Related Read: Lower Your Credit Utilisation Fast: 2025 Expert Strategies

3. Credit History Length (Approx. 15% Weight)

Credit history length measures how long you’ve been using credit responsibly. Lenders prefer a long track record of borrowing and paying back on time. This factor includes two metrics: your oldest account age and the average age of all your accounts.

Why it matters: A longer history gives lenders more data to assess your reliability. New users appear riskier simply because there’s less evidence of responsible behavior.

How to increase credit history length:

- Never close old credit cards, even if you don’t use them actively

- Keep old accounts open to maintain your history length

- Closing accounts actually shortens your average history and reduces available credit

- Use older cards occasionally to keep them active

- Focus on keeping established accounts rather than opening new ones

Ready to build a deeper history? Explore these proven tactics: 5 Fast Ways to Increase Credit History Length

4. Credit Mix & Types of Credit (Approx. 10% Weight) — Showing Your Versatility

A healthy credit mix shows you can manage different types of borrowing responsibly, such as revolving credit (credit cards) and installment loans (home loans, personal loans).

Types of credit that matter:

- Revolving credit: Credit cards, lines of credit (you borrow, repay, and can borrow again)

- Installment credit: Personal loans, auto loans, home loans (fixed payments over a set term)

- Other credit: Student loans, retail accounts

Why it matters: Managing diverse credit types shows lenders you’re financially versatile and can handle various borrowing scenarios.

How to improve your credit mix:

- Don’t apply for new credit just to diversify—this backfires by creating hard inquiries

- Focus on responsibly managing the credit you already have

- If you have both credit cards and loans, use them responsibly—that’s sufficient

- Only take on new credit when you genuinely need it

Want to diversify? See the Best Credit Mix for a 750+ Credit Score

If you feel your mix is lacking, here are the steps you can take: 7 Ways to Improve Your Credit Mix Quickly

5. New Credit & Inquiries (Approx. 10% Weight)

This factor tracks how often you apply for new credit. Multiple applications in a short period signal higher risk to lenders, suggesting you might be seeking credit urgently due to financial distress.

Hard inquiries vs. Soft inquiries explained:

- Soft inquiries (you checking your own credit score): Zero impact on your score. Do this as often as you want.

- Hard inquiries (lenders checking for loan / credit applications): Can temporarily lower your score. Too many checks in a short timeframe raises red flags.

Key insight: One hard inquiry typically lowers your score by 5-10 points temporarily.

How to minimize inquiries:

- Only apply for loan / credit when absolutely necessary

- When comparing similar products (loans, credit cards), apply within 14-45 days so bureaus count multiple applications as a single inquiry

- Avoid shopping around excessively or applying speculatively

- Be strategic about timing your applications

Don’t let bad habits persist: 5 Common Credit Score Mistakes in India You Can Fix Today.

Checking & Monitoring Your Credit Score (the Essential Habits)

Before you can improve CIBIL score, you need to know where you stand. Let’s address the most common questions about checking your credit.

1. Score vs. Report: What’s the Difference?

Your CIBIL score is a three-digit number (typically ranging from 300-900 in India).

Your credit report is the detailed document behind that number. It includes your complete account history, current balances, payment records, credit inquiries, and any negative items like defaults or collections.

Why both matter: Your score gives you the overall picture at a glance. Your report shows the detailed story behind that number, and where errors might exist.

Action item: Check your credit report at least once per year to catch errors that could be incorrectly lowering your score.

Credit reports can be overwhelming, but they don’t have to be. Overwhelmed by Credit Reports? Here’s a Simple Breakdown.

2. Can Checking Your Score Hurt You?

Short answer: No.

Checking your own credit score is a soft inquiry and has absolutely zero impact on your score. You can check it as often as you want without any penalty. In fact, regular monitoring helps you track progress and catch fraud early.

What you should know:

- Soft inquiries (your checks, employer checks): No impact on score

- Hard inquiries (lender checks for applications): Temporary, minor impact

- Checking your score frequently is risk-free and recommended

Bottom line: Monitor your score regularly. It is one of the best credit repair practices you can adopt.

Find the expert-backed answer to this common question: How Often Should You Do a Free Credit Score Check Online?

3. How to Effectively Monitor Your Credit

Simply knowing your score is not enough. Effective monitoring means understanding why your score changed and catching problems early.

What to look for in a monitoring tool:

- Real-time updates from trusted bureaus

- Accurate data that matches your credit report

- Clear explanations of what caused score changes

- Alerts for new inquiries, accounts, or suspicious activity

- Personalized recommendations based on your specific situation

Choose a tool that does more than just show you a number. It should help you understand your credit and guide improvement efforts.

Related Read: Find the best app to check your credit score in India

Strategies to Fix and Repair Your Credit Score

If your credit score is damaged, recovery is possible. This section walks you through exactly what to do—whether you need to dispute errors, pay down debt, or find the fastest way to rebuild.

Step 1: Identify What’s Hurting Your Score

Start by understanding the specific problem. Is it a recent late payments? High credit card balances? Hidden collections accounts? Excessive inquiries?

What to do:

- Review your complete credit report carefully

- Identify which factor is pulling your score down most significantly

- Usually, the culprits are payment history issues or high credit utilization

- Calculate your exact utilization rate and payment delinquency status

- Look for errors, fraud, or accounts you don’t recognize

Why this matters: You can’t fix what you don’t understand. Targeting the biggest score-draining factor first delivers the fastest improvement.

Pinpoint the exact issues holding you back: What’s hurting your credit score—and how to fix it.

Step 2: Dispute Errors on Your Credit Report

Credit bureaus process millions of records daily. Human error and computer glitches are common. You may find incorrect late payments, wrong loan amounts, duplicate accounts, or accounts you never opened.

The good news: These errors are fixable—and removing them can boost your score significantly.

What you need to know about disputing CIBIL errors:

- Disputing takes time (typically 30-45 days) and requires documentation

- It’s absolutely worth doing if errors exist in your report

- You have legal rights to dispute inaccurate information

How to dispute:

- Gather documentation supporting your claim

- Contact the credit bureau in writing (follow their dispute process)

- Provide clear evidence (payment receipts, bank statements, etc.)

- Follow up regularly until the dispute is resolved

- Request written confirmation once errors are corrected

Pro tip: If disputing multiple items, prioritize the most damaging ones first (late payments are worse than inquiries, for example).

Learn the step-by-step process for challenging items on your report: Dispute Credit Inquiries Like a Pro.

Step 3: Focus on Quick Wins

Real improvement happens when you tackle the biggest score factors strategically.

The fastest path to credit score improvement:

- Pay down credit card balances (immediately lowers your utilization rate)

- Ensure all future payments are on-time (prevents further damage and starts rebuilding trust)

- These two actions deliver the quickest, most dramatic results

The complete, step-by-step plan for rapid improvement: 10 Proven Tricks to Improve Your Credit Score Fast.

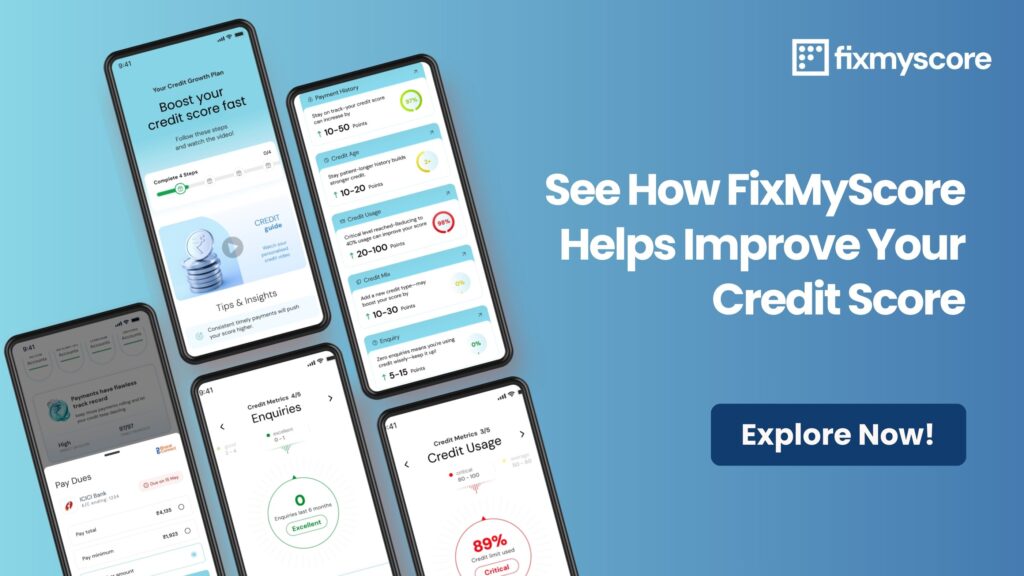

Step 4: Get Personalized Guidance

Your credit situation is unique. A generic improvement plan won’t work as well as a personalized strategy.

Why personalized guidance matters:

- Different actions have varied impact depending on the person

- Your biggest opportunity might be someone else’s minor issue

- An AI powered analysis can identify exactly which actions will move your needle fastest

- Personalized advice saves time and delivers measurably faster improvements

What personalized guidance should include:

- Priority ranking of which actions to take first

- Specific targets (e.g., “Pay this card down to Rs 15,000”)

- Timeline projections for score improvement

- Ongoing monitoring and adjustment as your situation changes

Learn about our personalized support model: Credit Advisory Services in India: How FixMyScore Helps You Achieve Financial Freedom.

The 750+ CIBIL Score Blueprint: Build, Maintain, Protect

Whether you’re starting from scratch or aiming for an excellent score, this section shows you how to build a strong credit profile and keep it that way.

1. Building Credit from Zero (Getting Started)

If you’re new to credit or have little credit history, you can’t repair what doesn’t exist—you must build it strategically and carefully.

How to start building credit:

- Open a secured credit card (requires a cash deposit but builds history quickly)

- Take a small, manageable personal loan and repay it responsibly

- Become an authorized user on someone else’s established account

- Pay all bills on time, starting with utilities if they report to bureaus

Building from nothing is slow but achievable. Most people see meaningful improvement within 6-12 months of consistent responsible behavior.

The first steps for anyone starting out: No Credit History Yet? Here’s Your Step-by-Step Plan to Build It from Scratch.

A powerful tool for new users or those rebuilding: Low or No Credit Score? How a Secured Credit Card in India Can Boost Your Score Fast.

2. Reaching the 750+ Tier (The Gold Standard)

A CIBIL score of 750+ opens the door to premium financial products. It qualifies you for:

- Lowest mortgage interest rates (potentially saving hundreds of thousands over 30 years)

- Best credit card offers with premium rewards

- Auto loan approval at competitive rates

- Highest personal loan amounts at best terms

750+ is achievable, but it requires discipline and consistency.

How to get there and stay there:

- Set up automatic payments so you never miss a due date

- Keep credit card balances below 10% of available limits

- Check your credit report quarterly for errors or fraud

- Maintain a healthy mix of credit types responsibly

- Limit new credit applications to only genuine needs

Your long-term plan starts here: How to Get a 750+ Credit Score: A 4-Step Blueprint for Beginners & Credit Repair.

3. Protecting Your Score Once You Have It

A high score can disappear quickly due to identity theft, fraud, or one major mistake. The best defense is awareness and proactive monitoring.

What to do:

- Regularly monitor your bank statements for unfamiliar transactions

- Check your credit report quarterly for unauthorized accounts

- Set fraud alerts with bureaus if you suspect activity

- Act fast if you spot something wrong

- Protect your personal information carefully

Defensive maintenance for long-term score health:

- Never share credit card numbers or personal details unsolicited

- Use strong, unique passwords for financial accounts

- Monitor credit inquiries for authorized vs. unauthorized applications

- Review statements immediately after receiving them

Learn The Most Common Credit Card Scams in India (And How to Avoid Them).

Start Your Credit Score Improvement Journey Today

Credit score improvement doesn’t have to be confusing or slow. By understanding these factors, committing to regular monitoring, and utilizing smart, data-driven credit repair strategies, you have the power to fundamentally change your financial future.

Don’t wait until you need a loan to find out where you stand. The time to improve your credit score is now—before you need it.

Ready to discover the fastest, most efficient path to a 750+ credit score?

See how our technology delivers tailored advice: Credit Score Improvement Made Easy with FixMyScore.

Quick Reference: Credit Score Improvement Checklist

- Check your current credit score and full credit report

- Identify your top score-draining factor

- Set up automatic payments for all accounts

- Create a plan to reduce credit utilization below 30%

- Dispute any errors found on your report

- Monitor your credit monthly for progress

- Keep old credit cards open after paying them off

- Limit new credit applications to genuine needs only

- Review your progress quarterly

- Celebrate milestones toward 750+

FAQs on CIBIL or Credit Score Improvement

1. How can I improve my credit score fast in India?

Improving your credit score fast in India usually means focusing on a few high-impact actions:

- Pay all EMIs and credit card bills on time – even one missed payment can hurt your CIBIL score.

- Reduce your credit card utilisation to below 30% of your limit across all cards.

- Clear or settle small overdue amounts first, so there are no “past due” flags on your report.

- Avoid applying for too many loans/credit cards at once, as multiple hard enquiries can temporarily dent your score.

These steps help improve CIBIL score in a matter of months, although deeper issues like past defaults can take longer to heal.

2. How long does it take to improve CIBIL score from 600 to 750?

Moving your CIBIL score from 600 to 750 usually takes 3–9 months, depending on:

- How severe your past delays or defaults are

- Whether you still have unpaid or written-off accounts

- How consistently you follow good credit behaviour (timely payments, low utilisation, no new unnecessary loans)

There is no instant credit score improvement, but if you maintain disciplined repayment and credit usage, you can see gradual improvement every few months.

3. Does checking my credit score frequently reduce it?

No. Checking your own credit score is considered a soft enquiry and does not reduce your score. In fact, monitoring your report regularly is recommended for credit score improvement because you can track progress in your efforts to improve credit score.

Your score is affected when lenders check your CIBIL report for a new loan or credit card (a hard enquiry), especially if you make many applications in a short period.

4. What is a good CIBIL score for getting a loan approved in India?

A CIBIL score of 750 or above is generally considered good for getting most loans and credit cards approved on favourable terms in India. Some lenders may approve even with a score between 700–749, but you might not get the best interest rates. The higher your score, the better your chances of approval and negotiation power, which is why structured credit score improvement is so important.

5. Why is my credit score low even though I pay on time?

Your score can still be low despite paying on time if:

- Your credit history is very short (you are “new-to-credit”)

- Your credit utilisation is consistently high, e.g., using 60–90% of your credit limit every month

- You have too many recent loan or card applications

- There are old settled or written-off accounts on your report

- There are errors in your credit report (wrong defaults, duplicate accounts, etc.)

For effective credit score improvement, review your detailed credit report, not just the number, to identify the exact reasons.

6. Does closing old credit cards affect my CIBIL score?

Yes, closing old credit cards can impact your score:

- You may lose length of credit history, which is a positive factor for your CIBIL score.

- Your overall available credit limit reduces, which can push up your utilisation ratio (if your spending stays the same), hurting credit score improvement efforts.

If a card is free or low-cost and you can manage it responsibly, it’s often better to keep your oldest card open and use it occasionally with full bill payment.

7. Is paying only the minimum amount due enough for credit score improvement?

No. Paying only the minimum amount due prevents late payment fees, but leaves a large revolving balance, which increases your interest burden and keeps your utilisation high. High utilisation and constantly revolving debt can drag down your CIBIL score over time. For genuine credit score improvement, try to pay the full amount due or as much as possible above the minimum.

8. What are the best long-term habits to improve CIBIL score?

For long-term, sustainable credit score improvement in India:

- Always pay EMIs and bills on or before the due date

- Keep credit utilisation below 30% of approved limits

- Maintain a healthy mix of credit (secured + unsecured) instead of only personal loans or only credit cards

- Limit new credit applications and only borrow when necessary

- Regularly review your credit report to detect and dispute any errors

These habits steadily improve CIBIL score and help you stay eligible for better loan offers, higher limits and lower interest rates over time.

[…] Recommended Read | The Ultimate Guide to Credit Score Improvement in India: Improve CIBIL Score 750+ […]

[…] Recommended Read: The Ultimate Guide to 750+ Credit Scores […]

[…] The Ultimate Guide to Credit Score Improvement in India: Improve CIBIL Score 750+ […]

[…] Recommended Read: The Ultimate Guide to 750+ Credit Scores […]

[…] Recommended Read: The Ultimate Guide to 750+ Credit Scores […]