Your credit score is your financial report card in India, determining whether you will get that dream home loan, car financing, or even a premium credit card. Yet many Indians unknowingly damage their credit scores through everyday financial mistakes. If your score is not where you want it to be, you’re not alone—and more importantly, it is fixable.

Here’s what’s pulling it down—and what you can do to fix it.

What’s hurting your credit score: The top 6 culprits

1. Late or missed payments

Missing even a single EMI or credit card payment can slash your CIBIL score by 50-100 points. Payment history makes up 35% of your credit score calculation, making it the most critical factor.

How to fix it:

- Set up auto-debit or auto-pay, or calendar reminders.

- If you missed a payment, clear it ASAP—that is the fastest way to avoid deep damage.

2. High credit utilization (above 30%)

Using more than 30% of your credit card limit regularly signals financial stress to lenders. For example, if your credit limit is ₹1 lakh, keeping your monthly usage below ₹30,000 is ideal.

How to fix it:

- Pay down credit card balances before billing cycles end.

- If possible, raise your credit limit or spread purchases across multiple cards.

3. Applying for too many loans or cards

Each hard inquiry by a lender can lower your credit score (typically 0–10 points). Applying for multiple loans or cards in a short time signals higher risk to lenders.

How to fix it:

- Space out your credit applications by at least 3-6 months.

- Compare loan options without submitting multiple applications.

- Apply only when you really need credit.

4. Closing old credit accounts

Your credit history length accounts for around 15% of your CIBIL score. Closing old cards reduces your credit history length and reduces your total available credit.

How to fix it:

- Keep old credit cards active with small purchases once every few months.

- Don’t close accounts unless there’s a compelling fee or risk involved.

5. Poor credit mix

Credit mix accounts for 10% of your score. A mix of secured loans (home/car) and unsecured credit (cards/personal loans) shows lenders you manage different credit types responsibly.

How to fix it:

- If you only have cards, consider a small personal loan or even a credit-builder loan.

- Don’t take unnecessary loans just for variety, but consider your overall credit portfolio.

6. Errors or identity fraud on your report

Mistakes—like account balance errors, missed payments you did pay, or even accounts opened fraudulently—drag your score down.

How to fix it:

- Check your credit report at least annually.

- Dispute any inaccuracies online—credit bureaus usually resolve them within 30–45 days.

How to check your credit score without hurting it

Many people worry that checking their credit score will damage it, but this is a common misconception. Here’s what you need to know:

Soft vs. Hard Inquiries:

- Soft inquiries (when you check your score) do not affect your credit score at all.

- Hard inquiries (when lenders check for loan applications) can temporarily lower your score by a few points.

Safe ways to monitor your score:

- Use official credit bureau websites such as CRIF

- Many banks now offer free credit score tracking in their mobile apps

- Third-party financial apps that show soft inquiry scores

Bonus tip: Slow & steady borrowing

The velocity of borrowing, how fast you take out new loans, now also influences your credit score, especially with the RBI pushing for daily credit updates. Fast borrowing may land you in trouble. Keep in mind, build a steady repayment track record before borrowing more.

Conclusion

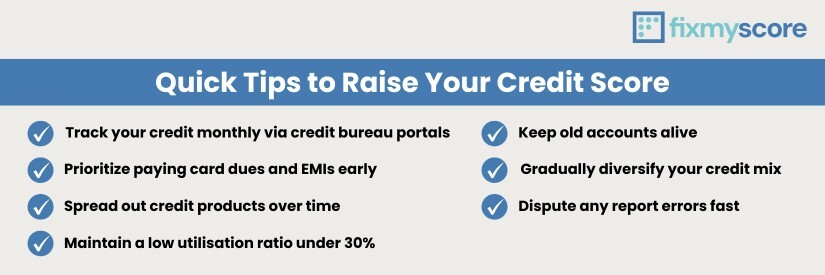

A high credit score is not magic—it is the result of responsible financial habits. Paying bills on time, keeping credit utilization low, and maintaining a long, error-free credit history all play a crucial role. Patience and consistency are essential. With 4–8 months of smart financial behavior, you can begin to see meaningful improvements in your score.

Monitor your credit report regularly, correct any inaccuracies, and borrow with intention. These simple yet strategic steps can help you reach that coveted 720+ score. Your future self will thank you for your next loan or credit card approval.

FAQs

- How often should I check my credit report?

At least once a year, or sooner if applying for a big loan. - Will paying only the minimum due hurt my score?

Yes—high balances linger. Always pay more than the minimum. - Does closing a credit card lower my score?

It potentially can, especially if it is your oldest or highest limit card. - Can I remove late payments from my report?

No—but you can dispute genuine errors or negotiate with lenders for “goodwill adjustments.” - What’s a good credit utilization ratio?

Ideally under 30%, both per card and overall. - How to check your credit score without hurting it?

You can check your credit score as many times as you want without any impact. Only use official credit bureau websites, bank apps, or authorized third-party services that perform “soft inquiries.” These do not affect your score, unlike hard inquiries from loan applications. - What’s hurting your credit score the most?

Late payments are typically the biggest score killer, potentially dropping your CIBIL score by 50-100 points. High credit utilization (above 30%) and frequent credit applications are some major factors that can significantly damage your score.