Think of your credit score as your financial report card—it tells banks and non-banking finance companies how trustworthy you are with credit. A good score opens doors to better interest rates, higher loan approvals, and more financial opportunities.

Your score influences more decisions than you might realize. Banks, fintech companies, and lending platforms use it to evaluate you. It directly impacts:

- Loan approvals for homes, cars, and other personal needs

- Credit card eligibility and limits

- Buy now, pay later service access

- Insurance premium rates

- Employment opportunities in financial sectors

Maintaining a good credit score is not just about qualifying for loans—it quietly shapes your entire financial landscape and can save you thousands of rupees over time.

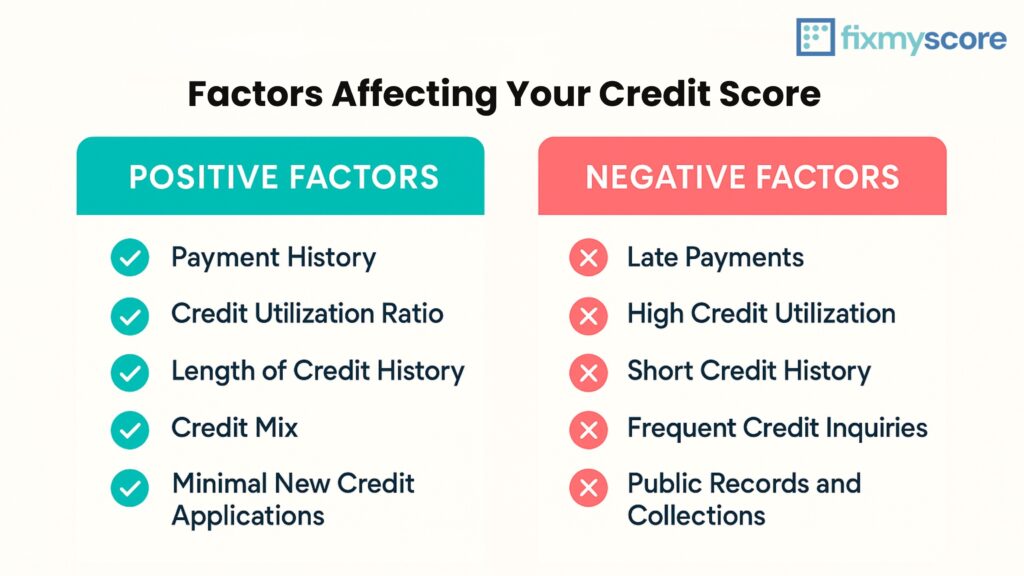

What Makes Up Your Credit Score

Payment History – The Big One

Your payment history is the #1 factor — making up the biggest slice of your credit score pie. Missed a payment? Your score feels it instantly.

Late payments stay on your report for years. One or two slips may seem minor, but they add up fast. Set reminders, automate bills, or use apps to stay on schedule. Paying on time is the easiest way to boost or destroy your score.

Credit Utilization – Keeping the Balance Low

This one’s simple: the less credit you use, the better. Aim to use less than 30% of your credit limit. So if you have ₹1,00,000 in credit, keep your balance under ₹30,000.

Using too much credit can make lenders think you’re in financial trouble — even if you pay it off later. Keep balances low, pay early if needed, and your score will thank you.

Length of Credit History – Time Tells All

How long you’ve had credit also matters. Lenders trust a long, clean record. The older your accounts, the better — even if you barely use them.

New to credit? Start small and keep accounts open. Have an old credit card collecting dust? Don’t close it. It’s adding years to your credit history, and that is a good thing.

Credit Mix – Variety is Healthy

Lenders love to see a mix — credit cards, loans, maybe a mortgage. A good variety showsyou can handle different types of credit responsibly.

It is not about quantity, though. A couple of well-managed credit types are better than juggling too many.

New Credit Applications – Too Many Can Hurt

Every time you apply for credit, a hard inquiry is added. Only apply when necessary. Too many applications at once can signal financial trouble. Spread them out to keep your credit score stable.

What Makes Your Credit Score Go Down

Late Payments – A Major Red Flag

Nothing pulls your credit score down faster than a late payment. Even if it’s just a few days past due, it can leave a lasting mark. Why? Because it signals to lenders that you might not be reliable.

A single missed payment can drop your score by dozens of points. Worse, late payments stay on your report for up to 7 years.

The fix? Stay organized. Set up auto-pay, schedule reminders, and review statements often. One small habit change can protect your score for years.

High Balances – Using Too Much Credit

Maxing out your credit cards or carrying large balances makes it look like you are overextended. This is called high credit utilization, and it’s one of the quickest ways to drag your score down.

Keep balances low, pay more than the minimum, and aim to pay before the billing cycle closes. That’s how you keep your credit looking lean and healthy.

Short Credit History – Incomplete Picture

If your credit history is new, or you’ve closed old accounts, lenders don’t have much to go on. A short or inconsistent credit timeline can lower your score simply because it lacks data.

The longer and more stable your credit track record, the more confident lenders feel. That’s why closing old credit cards (especially your oldest one) is rarely a good idea.

Build a long-term credit story. Keep old accounts open, avoid opening and closing credit accounts rapidly, and stay consistent.

What Makes Your Credit Score Go Up

Want to see your score go up fast? Start with these smart habits:

- Pay bills before the due date.

- Keep credit utilization under 30%.

- Don’t open or close too many accounts at once.

- Check your report regularly for errors.

Limit hard inquiries by spacing out applications.

Over time, these little changes build momentum. And momentum is what turns an average score into an excellent one.

Why Real-Time Credit Monitoring Matters

Most people only look at their credit score when applying for a loan. But by then, it might be too late to fix any issues. That’s where FixMyScore changes the game — with regular updates and insights, you always know where you stand.

Monitoring your credit in real-time means you can:

- Spot suspicious activity early

- Track the impact of your financial decisions

- Avoid unpleasant surprises during loan approvals

- Keep improving with focused action steps

Conclusion

By understanding what makes up your credit score and what affects it, you gain the power to improve it. Timely payments, low balances, long-term credit accounts, a healthy credit mix, and cautious application behavior — they all play a part.

If you have been wondering how to make your credit score go up fast, start with smart habits and consistent monitoring. Use tools like FixMyScore to stay on top of your game, fix the weak spots, and grow your score over time.

FAQs

1. What is a good credit score?

A score above 700 is generally considered good and can help you qualify for better loan offers and interest rates.

2. How often should I check my credit score?

At least once every quarter — or more frequently if you’re planning a big purchase or working to improve your score.

3. Does checking my score hurt it?

Not at all. When you check your own credit score, it is a soft inquiry and does not affect your score.

4. What makes your credit score go down the most?

Late payments and high credit utilization are usually the biggest culprits. Keeping these in check is key.

5. Can I raise my credit score in 30 days?

Yes — by lowering credit utilization, paying off recent balances, and correcting any errors on your report, you can often see a noticeable bump quickly.