Ever found yourself eyeing that shiny new phone, laptop, or big appliance, only to hesitate at the price tag? We all have been there. That’s exactly where credit card EMIs come in as lifesavers. With just a few taps or a call, you can break down a large purchase into smaller, manageable monthly instalments. Sounds like a win, right?

But before you go ahead and convert a big credit card purchase to EMI, it is essential to understand how it works, the actual cost involved, and whether it really fits your financial plan. Let’s break it all down.

What is Credit Card EMI?

In plain terms, a credit card EMI (Equated Monthly Instalment) lets you pay for high-ticket purchases over a period of time instead of one large lump sum. Think of it as splitting your credit card bill for a specific transaction into bite-sized pieces you can pay off monthly.

Let’s say you swipe your card for ₹60,000 on a smart TV. Instead of paying the full amount in the next billing cycle, you convert it into a 12-month EMI of ₹5,500 (depending on interest and fees). Convenient? Absolutely.

How Credit Card EMI Works

When you opt for an EMI conversion, your bank essentially treats your purchase like a short-term loan. Here’s a step-by-step on how credit card EMI works:

- Transaction eligibility: Only purchases above a certain value (usually ₹3,000–₹5,000) qualify.

- Select tenure: You choose a repayment period, often 3, 6, 9, 12, or 24 months.

- Interest rates apply: The bank adds a monthly interest (unless it’s a no-cost EMI).

- Monthly billing: The EMI is added to your monthly credit card statement.

- Credit limit block: The full purchase amount is blocked against your limit initially and released gradually as you pay.

You can usually convert your purchase through:

- The bank’s mobile app or net banking

- Customer service

- At POS terminals during purchase (merchant-tied EMI offers)

Benefits of Converting Purchases to EMI

- Budget-friendly: Instead of shelling out ₹60,000 at once, you pay ₹5,000/month.

- Improves affordability: Lets you buy what you need without waiting months to save up.

- No-cost EMI options: During sales or with select merchants, you might not even pay interest.

- Immediate ownership: Get the product or service today, pay later without stress.

- Flexibility: Various tenure options help match your repayment capacity.

Common Tenure Options Available

EMIs are not one-size-fits-all. Depending on your card issuer and the purchase amount, you usually get options like:

- 3 months

- 6 months

- 9 months

- 12 months

- 18 months

- 24 months

Shorter tenures mean higher monthly outgo but lower interest. Longer tenures reduce monthly pressure but might cost more in total due to added interest. Choose what fits your budget, not just what seems easiest now.

Interest Rates and Charges Involved

Here’s where things get real. While EMI helps with budgeting, it is not always free.

Typical charges include:

- Interest rates: 13%–24% per annum, depending on tenure and bank.

- Processing fee: A one-time fee of 1%–2.5% on the purchase amount.

- Foreclosure/pre-closure charges: 2%–3% if you want to repay the EMI early.

So, always check the credit card EMI charges before opting in. Some banks also charge GST on interest or processing fees. These costs quietly add up and impact your total outflow.

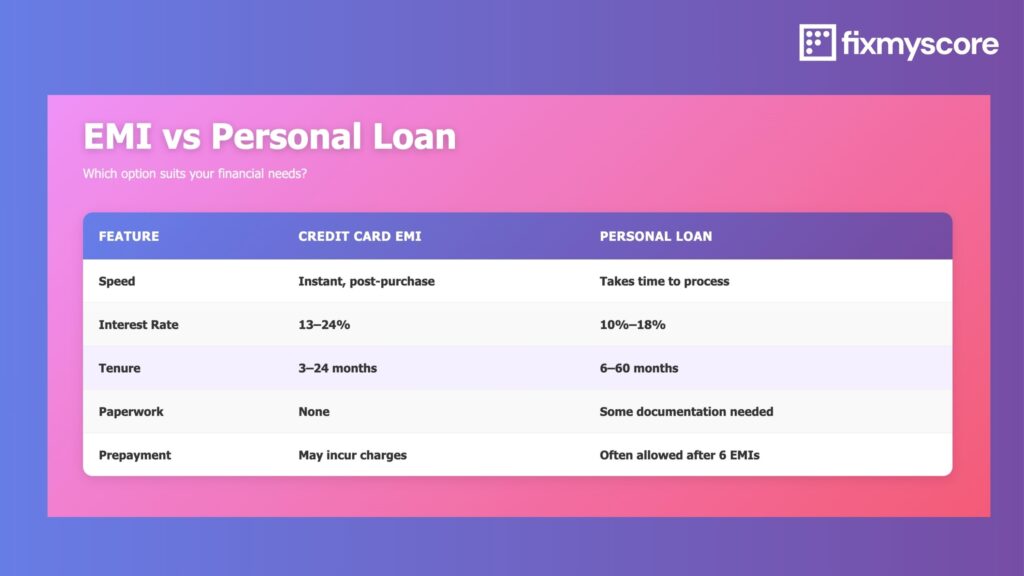

Credit Card EMI vs Personal Loan

Both serve similar purposes, spreading out payments, but they are different tools.

So, if you need quick financing for a single big spend, credit card EMI is handy. For larger or cash-based needs, a personal loan may be better.

Should I convert my Credit Card to EMI?

That depends. Ask yourself:

- Can I repay within the chosen tenure?

- Am I okay with paying interest?

- Is the product/service worth the cost + interest?

If you are short on cash but sure of future income, it is a good solution. But if you’re already juggling multiple EMIs or uncertain income, think twice.

Pros and Cons of Credit Card EMI

| Pros | Cons |

| Easy, instant conversion | Interest and fees can be high |

| No paperwork required | Reduces available credit limit |

| Improves cash flow | Foreclosure charges may apply |

| Sometimes no-cost | May tempt overspending |

Impact on Credit Score

A credit card EMI is still a form of debt. If you repay on time, it builds your credit score. But if you default or miss payments, it negatively affects it.

Also, since the full amount is blocked against your credit limit initially, it reduces your available credit, which impacts your credit utilization ratio.

Recommended Read: 5 Common Credit Score Mistakes in India You Can Fix Today

How to Convert Credit Card Purchase to EMI

Here’s how you do it:

- Online: Log into your net banking or mobile app, select the eligible transaction, and choose “Convert to EMI.”

- Customer service: Call your bank’s helpline and place a request.

- Point-of-sale: At some stores, EMI options are offered directly at checkout.

Make sure you understand the EMI plan, interest, and tenure before confirming.

Can You Prepay a Credit Card EMI?

Yes, most banks allow it, but there’s a catch.

- Pre-closure charges: 2%–5% on remaining principal.

- Conditions: Usually allowed only after 3 EMIs are paid.

If interest costs are high, and you can afford to prepay, it may be worth doing despite the penalty.

EMI on No-Cost vs Regular Interest EMI

A no-cost EMI sounds amazing, but is it really free? Not always.

How it works:

- The merchant offers a discount equal to the interest.

- The bank still charges interest, but it’s offset.

So, you pay only the product cost in instalments. But sometimes, no-cost EMI means reduced discounts or bundled charges. Always do the math.

Managing Credit Card EMI Repayments Smartly

- Set reminders: Ensure EMIs are paid on time every month.

- Avoid the minimum due trap: Pay the full EMI amount, not just the minimum due.

- Don’t stack EMIs: Too many EMIs = risk of default.

- Use EMI calculators: Plan your payments before committing.

Smart repayment protects your credit score and keeps you debt-free.

Mistakes to Avoid When Opting for Credit Card EMI

- Ignoring the fine print

- Not checking the total cost after interest

- Choosing a longer tenure just for smaller EMIs

- Forgetting about processing or foreclosure fees

- Overusing EMI and losing track of monthly liabilities

Avoiding these mistakes helps you make the most of the facility.

Conclusion

Credit card EMIs are a powerful tool when used wisely. They give you the freedom to make essential purchases without derailing your budget. But like any credit product, they come with strings attached. Take time to understand how credit card EMI works, compare options, calculate real costs, and always stay on top of repayments.

Used smartly, it can help you balance needs, wants, and cash flow with zero stress.

FAQs

1. Is converting to EMI better than paying in full?

If you can afford to pay in full without affecting your finances, always do that. EMI is helpful only when cash flow is tight.

2. What happens if I miss a credit card EMI payment?

You’ll be charged late fees, your credit score may dip, and interest keeps compounding.

3. Can I convert past transactions to EMI?

Yes, most banks allow conversion within 30–60 days of the purchase.

4. Does EMI affect my credit card limit?

Yes, the full transaction amount is blocked initially and released as you repay monthly.

5. Are no-cost EMIs truly interest-free?

Technically, no. The interest is usually borne by the merchant or adjusted through reduced discounts.