In today’s fast-moving financial landscape, your credit score is your silent and important partner in unlocking growth opportunities. From getting a home loan at lower interest rates to qualifying for premium credit cards with better rewards, a strong credit score opens doors. Yet, for many Indians, credit score improvement feels confusing, time-consuming, and overwhelming.

Manual tracking of bills, decoding complex credit reports, and fixing errors often leads to frustration. That’s where FixMyScore, a smart Credit Score Improvement App, makes a difference. With its AI-powered tools and personalized insights, it transforms credit score management in India into a simple and trusted journey.

Let’s explore why credit score improvement is challenging in India, how FixMyScore addresses these issues, and the benefits you gain from using one of the best credit score tools in India.

Why Credit Score Improvement is Challenging in India

For many Indians, credit management is not straight forward. Here are some common challenges:

- Complex Credit Reports: Credit reports are filled with jargon that is hard to interpret, making it difficult to know what’s really affecting your score.

- Manual Tracking Hassles: With multiple loans, EMIs, and credit cards, remembering every due date is tough. A single missed payment can cause long-term damage.

- Lack of Early Warnings: Most people only check their credit score when applying for a loan—by then, it is often too late to fix issues.

- Difficulty Fixing Errors: Errors like wrongly reported defaults or incorrect balances are common. Getting them corrected is slow and stressful.

These problems show why we need more than just a basic score checker. What’s needed is a credit score app in India that provides proactive, step-by-step support.

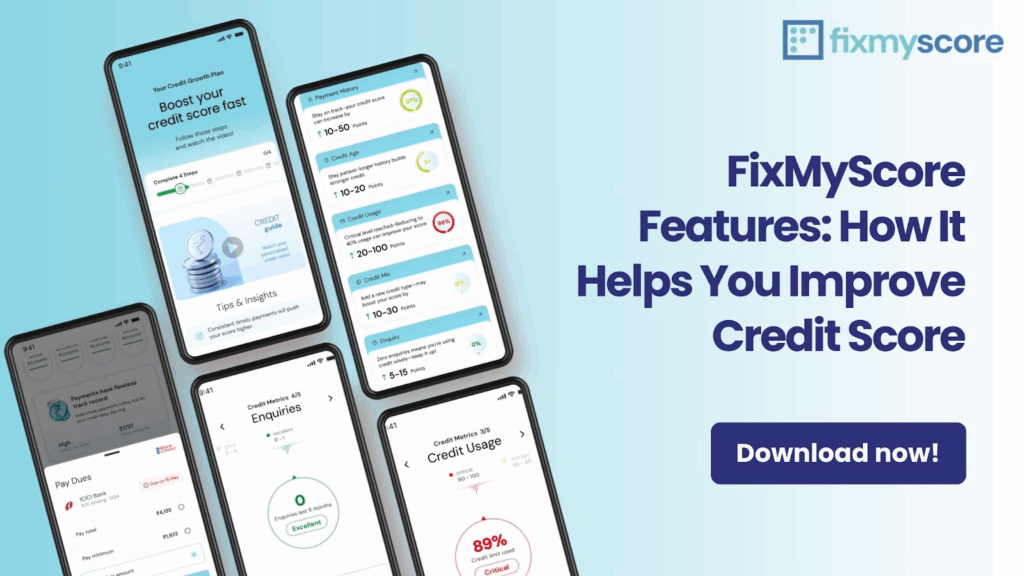

FixMyScore Features: How It Helps You Improve Credit Score

FixMyScore has been built to tackle these challenges head-on. Here are the key capabilities that set it apart:

1. Instant Credit Score & Report Access with Simplified Insights

- You can check your credit score instantly and access your full credit report within the app.

- The app breaks down what’s helping or hurting your score in clear language, using AI to translate jargon into insights.

- No more guesswork, you see exactly which factors are dragging or boosting your score.

2. Personalized Action Plan with AI-Powered Video Guidance

- Don’t just learn that your score is low; find out why and how to fix it. The app delivers customized video advice tailored to your credit profile.

- You get a step-by-step plan aligned with your current financial health and your target (e.g., reaching a 750+ score).

3. Smart Payment Reminders & In-App Payment Support

- Missing payments is one of the top reasons scores drop. The app sends smart alerts to keep you on track.

- You can pay instantly through the app to avoid delays or forgetfulness.

4. Debt Settlement Support

- FixMyScore goes beyond monitoring: it lets you negotiate settlements on defaulted loans with expert support.

- This lets you clean up your credit history by resolving past negative entries (if possible).

5. Unified Dashboard: All Accounts in One Place

- No need to juggle between banking apps. FixMyScore lets you view and manage all credit accounts (cards, loans, EMIs) from one dashboard.

- You can track payments, set reminders, and make one-tap payments in a unified interface.

6. Goal-Oriented Financial Planning

- Align your credit score with your financial goals.

- The app helps you prepare for major milestones like home loans, car finance, or improving your overall financial health.

7. Transparency, Security & Trusted Partnerships

- The app works with authorized credit bureaus like CRIF to deliver accurate and trustworthy reports.

- Data security is a priority: bank-level encryption and strict privacy protocols protect your information.

- You remain in control as only essential data is accessed, and always with your explicit consent.

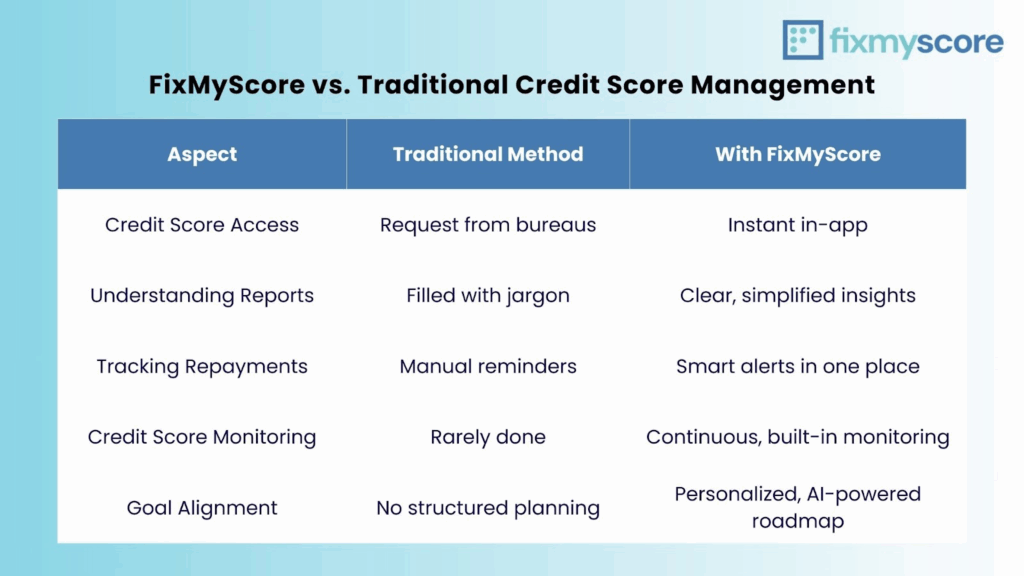

FixMyScore vs. Traditional Credit Score Management

FixMyScore does not just monitor your credit health; it guides, corrects, and helps you grow your credit score actively.

How FixMyScore Helps You Solve Common Credit Score Problems

Let’s match the problems people face with how this app helps:

- Problem: “I don’t know what’s hurting my score.”

- Solution: Clear AI-driven insights explain exactly which factors are dragging your credit.

- Problem: “I forgot a bill and my score dropped.”

- Solution: Smart payment reminders + in-app payment support help you stay consistent.

- Problem: “I have defaulted loans from years ago.”

- Solution: Use the debt settlement and record-cleanup support to negotiate and remove negative entries.

- Problem: “I have many accounts to track.”

- Solution: One unified dashboard where you manage all credit accounts together.

- Problem: “I don’t see improvement even after following tips.”

- Solution: The personalized action plan adapts to your current state and gives you precise guidance.

Why Credit Score Improvement in India Matters

A higher credit score is more than bragging rights; it directly impacts your financial opportunities:

- Better Loan Terms: Lower interest rates on home, car, and personal loans.

- Higher Credit Card Limits: Access to premium cards with better perks.

- Easier Approvals: Faster approval for credit-based applications.

- Stronger Financial Health: A foundation for long-term financial freedom.

By using FixMyScore, you are not only fixing a low credit score in India but also building the financial credibility needed to achieve your dreams.

Conclusion: Take Control of Your Financial Future

In India’s evolving financial landscape, a strong credit score is your gateway to better opportunities. Yet traditional credit management methods are outdated, confusing, and stressful.

FixMyScore changes that. With its smart insights, real-time tracking, and actionable tips, it is the most effective way to fix bad credit scores and achieve long-term financial health.

If you are wondering how to improve your credit score in India, now is the time to act.

Relevant Reads:

[…] must consistently monitor your credit report. This is where FixMyScore becomes your best ally. Our AI-driven platform helps you identify discrepancies and inaccuracies […]

[…] See how our technology delivers tailored advice: Credit Score Improvement Made Easy with FixMyScore. […]