Your CIBIL score is like your financial reputation—silent, invisible, yet incredibly powerful. Whether you’re applying for a credit card, dreaming of your first home, or simply looking to upgrade your lifestyle with a personal loan, your CIBIL score can make or break your chances. But what exactly are the benefits of a high CIBIL score? Let’s dive into five powerful advantages that can reshape your financial future.

Let’s discuss the five powerful benefits of a high CIBIL score, with FixMyScore insights that could transform the way you manage your money.

What is a CIBIL score, anyway?

Before we explore the benefits, it’s important to understand what a CIBIL score is. Managed by TransUnion CIBIL, this score ranges from 300 to 900, with anything above 750 considered excellent. It reflects your creditworthiness based on your repayment history, outstanding loans, credit utilization, and other financial behavior.

Now, let’s see why this score is more than just a number.

1. Quick & Easier Loan Approvals

One of the most immediate perks of a high CIBIL score is faster loan approvals. Banks and financial institutions use your credit score as a snapshot of your creditworthiness. A score above 750 tells lenders, “This person is reliable.”

Think about it—would you lend money to someone with a poor repayment history? Probably not. Lenders think the same way.

Why it matters:

- Higher scores reduce your risk in the eyes of lenders

- You’re more likely to be pre-approved for loans

- Quicker disbursals with less paperwork

As per financial experts, lenders prioritize applicants with scores above 750, streamlining the loan disbursal process. When your CIBIL score shines, you don’t just knock on the lender’s door—they open it for you.

2. Lower Interest Rates

A high CIBIL score can save you money—thousands of rupees over the loan term. Borrowers with a high CIBIL score are often offered lower interest rates.

Here’s how it benefits you:

- You pay less interest over the loan tenure

- Lower EMIs give you more breathing space in your monthly budget

- You get access to exclusive loan offers

For example, someone with a score of 800 may be offered a personal loan at 10.5%, while another person with a 650 score might get it at 12% or higher. That’s a significant difference in your EMIs and total interest paid.

Also, you can use this score as a negotiation tool. When you have a high score, don’t hesitate to ask for a better deal.

3. Higher Credit Card Limits & Premium Offers

A strong CIBIL score doesn’t just help you get a credit card—it gets you the best credit cards with attractive benefits. Think travel perks, cashback offers, and VIP services. Lenders reward responsible users with higher credit limits and premium cards.

What to expect with a good score:

- Easier approval for high-limit cards

- Access to elite credit cards like Platinum or Signature variants

- Enhanced reward points, lounge access, and priority support

Banks trust that you will handle your credit responsibly, so they are more comfortable offering generous limits. This not only boosts your spending power but also helps maintain a low credit utilization ratio, further improving your score.

4. Better Chances of Loan Pre-Approvals

If you’ve maintained a good CIBIL score over time, banks may offer you pre-approved loans. These are often:

- Instant

- Hassle-free

- Paperless

Similarly, for ongoing loans, a strong score increases your chances of getting top-up loans at competitive rates. Whether you are planning a home renovation, funding education, or covering a medical emergency, having access to quick funds with minimal effort can be a lifesaver.

Also Read: 7 Ways to Improve Your Credit Mix Quickly

5. Faster Access to Emergency Funds

Life is unpredictable. Whether it is a medical emergency, sudden travel, or an unplanned expense, your credit score can be your silent savior. With a high CIBIL score, you gain quicker access to emergency credit, including instant personal loans or top-up options.

Why this matters:

- Online loan approvals in minutes

- Quick credit disbursal to your bank account

- Less documentation and verification are required

In tough times, speed and simplicity can make a huge difference. A high credit score ensures you’re not left hanging when time is of the essence.

Recommended Read: The Ultimate Guide to 750+ Credit Scores

Conclusion: Your Score, Your Superpower

Your CIBIL score isn’t just a statistic—it’s your financial character in numbers. It affects not just your ability to borrow, but how much you pay and how you’re treated by financial institutions. In a world driven by credit, maintaining a high CIBIL score is like walking into every financial conversation with a golden badge.

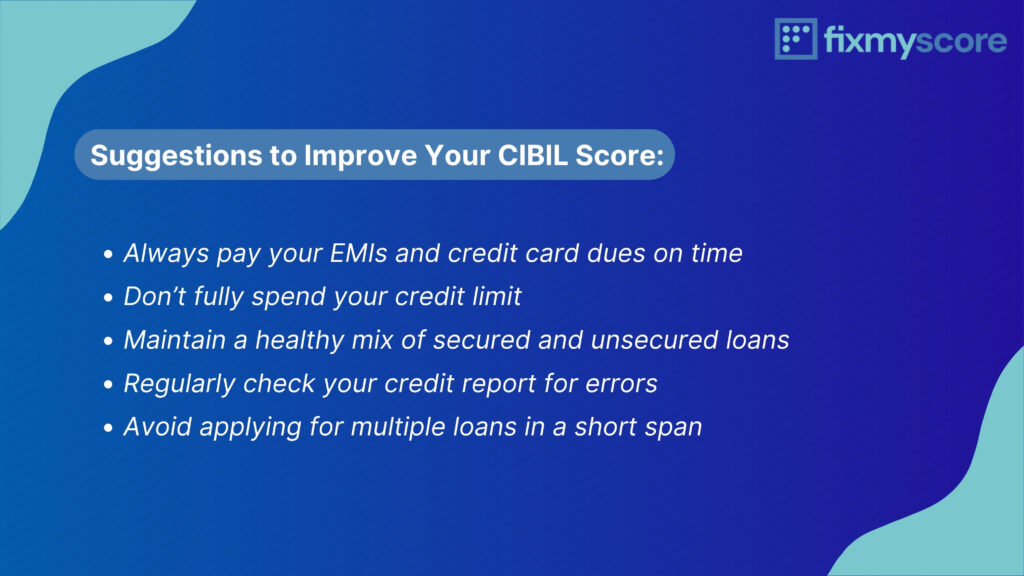

Maintaining a high CIBIL score is not rocket science. It is about staying disciplined—paying EMIs and credit card dues on time, keeping your credit utilization low, and avoiding unnecessary loans. The benefits are long-term, impactful, and deeply empowering.

FAQs

1. What is considered a good CIBIL score?

A score above 750 is generally considered good and opens the doors to the best financial products and rates.

2. How can I improve my CIBIL score quickly?

Pay your EMIs and credit card bills on time, reduce outstanding debt, and avoid multiple loan applications in a short span.

3. Does checking my CIBIL score lower it?

No, checking your credit score is called a “soft inquiry” and does not affect your score.

4. Can I get a loan with a CIBIL score below 700?

It is possible but difficult. You may face higher interest rates, lower loan amounts, or rejections.

5. How often should I check my CIBIL score?

At least once every 3-4 months, to stay updated and spot errors early.

[…] Recommended Read: 5 Powerful Benefits of a High CIBIL Score | FixMyScore Insights […]

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/register?ref=IXBIAFVY

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/vi/register-person?ref=MFN0EVO1

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/en/register-person?ref=JHQQKNKN

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/zh-CN/register?ref=WFZUU6SI

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/sl/register-person?ref=I3OM7SCZ

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/es-AR/register-person?ref=UT2YTZSU

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/sl/register?ref=I3OM7SCZ

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for finally talking about > 5 Powerful Benefits of a High CIBIL Score winpot

Your enticle helped me a lot, is there any more related content? Thanks!